Choosing how to manage your company’s finances can shape everything from daily operations to long-term growth. Some businesses thrive with an internal hire, while others get more value by working with an outside team. The key is knowing which approach fits your goals, budget, and workflow.

Understanding the Basics: In-House vs. Outsourced Accounting

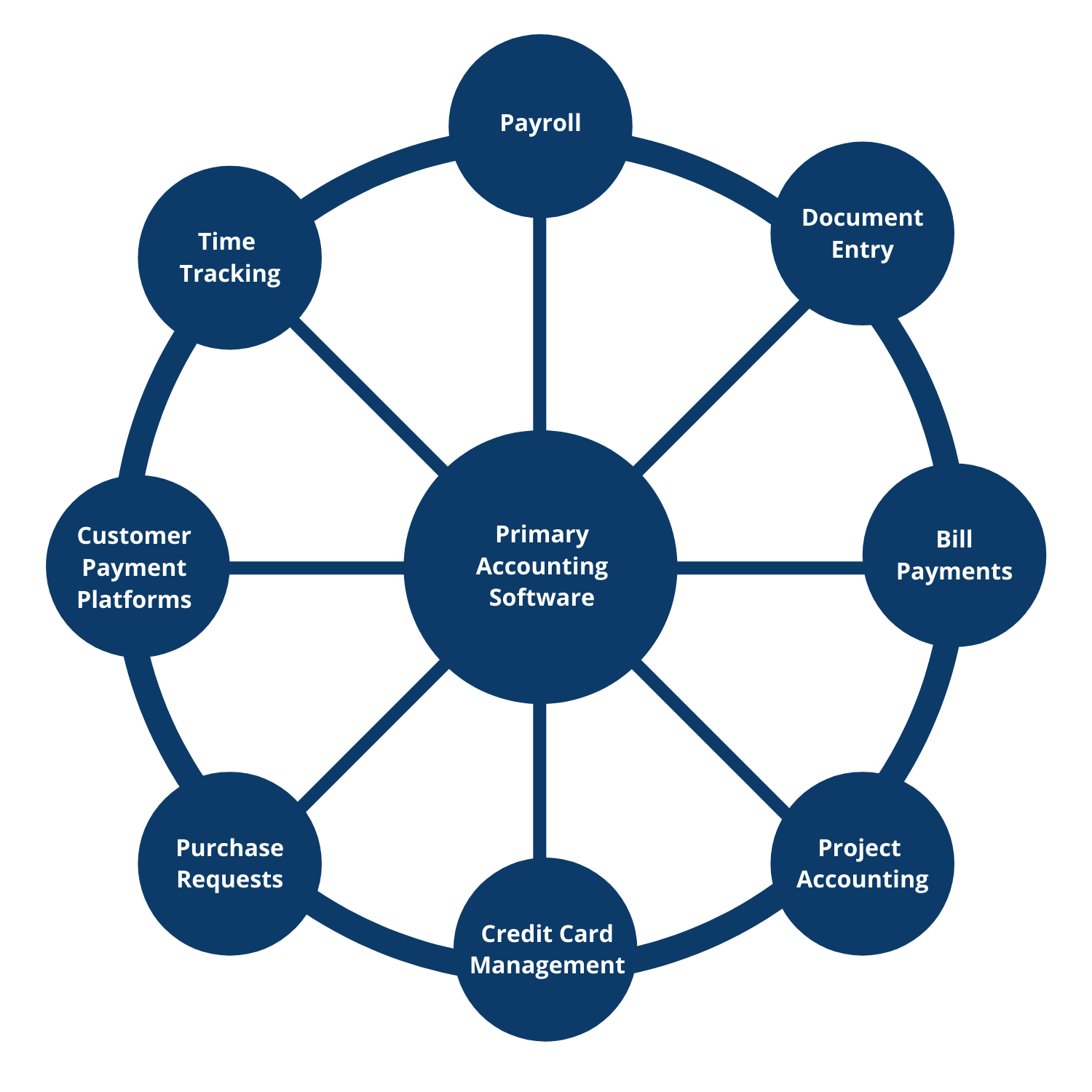

Outsourced accounting involves partnering with an external firm or independent contractor to handle your business’s financial needs—things like bookkeeping, payroll, reporting, or strategic planning. These services are typically provided remotely and can be adjusted based on how much support you need.

In-house accounting means hiring someone who works directly for your business, either as a full-time or part-time employee. This person becomes part of your internal team and is often more immersed in your day-to-day operations.

Both models can work well. The best fit depends on what your business needs today—and where you're headed.

The Pros and Cons of Outsourced Accounting

Pros:

-

Flexible support: An outsourced team can scale up or down based on your workload, seasonality, or business stage. This flexibility can be helpful for companies experiencing growth or change.

-

Broad expertise: Firms that work with many clients tend to build deep industry knowledge and keep up with best practices and tools.

-

Established systems: Outsourced teams often bring efficient, proven processes—everything from billing to reporting—so you don’t have to build those workflows from scratch.

-

Lower overhead: You’re not responsible for benefits, equipment, or paid time off. That often means lower total costs than hiring in-house.

-

Built-in continuity: If someone leaves the outsourced team, they typically have backups and support systems to keep things running smoothly.

Cons:

-

Shared availability: Contractors usually split their time across multiple clients, so they may not be instantly available for every request.

-

Less flexibility for custom processes: Many firms standardize how they work to stay efficient. If your business relies on highly specific workflows, this could be a challenge.

-

Takes time to learn your business: While a good onboarding process helps, external partners still need time to fully understand your systems, culture, and clients.

The Pros and Cons of In-House Accounting

Pros:

-

Immediate access: Having someone on-site or in constant communication makes it easier to address quick questions or loop them into discussions on the fly.

-

Tailored to your way of working: An in-house employee can often take on one-off projects or support tasks outside of traditional accounting, like proposal prep or internal reporting tools.

-

Embedded understanding: Over time, your in-house team becomes more familiar with your team, your clients, and your internal priorities.

Cons:

-

Higher total cost: Salary, benefits, training, equipment, and management time all contribute to a larger financial investment.

-

Recruitment and retention challenges: Hiring takes time—and turnover can leave you without support when you need it most.

-

Limited perspective: An in-house accountant may not be exposed to as many tools, strategies, or problem-solving experiences as someone working across multiple businesses

Which Option Fits Your Budget?

Comparing the cost isn’t always straightforward. An outsourced partner might charge a higher hourly rate, but they tend to work more efficiently and require less overhead. Many companies spend less overall and still get access to more advanced tools and insights. That said, once a business reaches a certain size or complexity—say, consistent multi-million-dollar revenue or very involved financial forecasting—it may make sense to bring someone in-house. At that stage, you may need more constant oversight or deeper involvement in strategic planning.

Some businesses find a hybrid model works best: hiring a controller or finance lead internally, while still outsourcing specific tasks like bookkeeping, reporting, or software support.

Making the Right Choice for Your Business

Smaller or growing businesses often find outsourced accounting offers more value and fewer hiring headaches. But as you scale, building an in-house team—or combining internal and external support—may give you more control and continuity. Ask yourself:

- How complex are your financial operations?

- How often do you need input from your accountant?

- Are you growing quickly, or in a more stable phase?

- Do you need specialized tools or industry-specific expertise?

- What’s your budget—and how much flexibility do you need?

No matter which direction you choose, reliable financial insight helps your business thrive. So, whether you’re building an internal team or leaning on outside expertise, the right setup can free up your time, reduce stress, and give you a clearer picture of where you’re headed.