The Accounting Frontier Blog

Empowering professional services and interior designers with CFO expertise, financial optimization, and automation for sustainable growth and success.

Outsourced vs. In-House Accounting: Which is Right for Your Business?

Choosing how to manage your company’s finances can shape everything from daily operations to long-term growth. Some businesses thrive with an ...

Bookkeeping

How Outsourced Accounting Services Enhance Financial Transparency

Financial transparency is the foundation of trust, informed decision-making, and sustainable growth. But for many small to mid-sized businesses, ...

Bookkeeping

Key Services Offered by Top Bookkeeping Firms

Strong bookkeeping keeps businesses running smoothly—but the best outsourced firms do more than just track income and expenses. They provide insights ...

CFO

The Strategic Advantage of Outsourced CFO Services

Every business needs strong financial leadership, but hiring a full-time CFO isn’t always practical—especially for small and mid-sized businesses. ...

Bookkeeping

Streamline Your Interior Design Business with Financial Tracking

It's time to bring the same level of elegance to your bookkeeping as you do to your designs. In this guide, we'll explore how to master the financial ...

Bookkeeping

What to Expect When Hiring an Outsourced Accounting Firm

Hiring an outsourced accounting firm can be done quite easily with the right steps. Finding the right partner can improve your financial wellbeing ...

Automation

The Benefits of Cloud-Based Accounting Software

Cloud-based accounting software is a modern evolution that can transform how you handle your finances. In this blog, we'll break down the benefits ...

Automation

Leveraging Automation in Accounting for Greater Efficiency

Remember the days of handwritten ledgers and manual calculations? Accounting has definitely come a long way since then. The introduction of computers ...

CFO

Understanding Outsourced CFO Services

In the interest of keeping costs low, many small businesses opt out of hiring a full C-suite, which leaves them navigating finances without the ...

Automation

The Future of Finance: How Automation is Reshaping Accounting

The accounting industry is currently experiencing a significant transformation, fueled by the rapid advancements in automation technologies. This ...

Budget

How Outsourced Bookkeeping Can Transform Your Business Operations

As a business owner, you're constantly seeking ways to streamline operations and boost your bottom line. One powerful strategy that's gaining ...

Bookkeeping

Essential Bookkeeping Services Every Small Business Needs

Discover the crucial accounting services that can help small businesses thrive and succeed.

CFO

Cash Flow Forecasting: A Key Tool for Interior Designers

Accounting at its core is based on historical data. Transaction entry for most small businesses is at most caught up through the prior week, but it ...

CFO

Top 5 Essential KPIs for Interior Design Businesses

Last updated on July 2, 2024: We've refreshed this article to reflect recent developments and trends, keeping you well-informed. Key Performance ...

Bookkeeping

Simplifying Bookkeeping for Interior Design Businesses: Key Strategies for Success

Last updated on July 2, 2024: We've refreshed this article to reflect recent developments and trends, keeping you well-informed. Managing bookkeeping ...

CFO

How much cash is really mine?

There's an illusion out there that you can simply look at your bank balance and judge how healthy your business is. While that may be somewhat true ...

Interior Design

Interior Design Billing Practices That Free Up Cash Flow

Choosing the optimal billing method is critical to streamlining your interior design accounting process and freeing up cash flow. Learn more about ...

Interior Design

How to Choose the Right Interior Design Accounting Process

Accounting for interior designers can be complex — but it doesn’t have to be. Learn more about streamlining procurement, developing a budgeting ...

Bookkeeping

Excel Uploads

There will often be times where a software may not connect to your accounting software, but you can still automate the entry of data through an excel ...

CFO

Maximum Capacity

What is the maximum amount of revenue you can generate based on your current processes and systems? This answer to the “Maximum Capacity” question ...

CFO

Burden Rate

In today’s post, we’re going to review the concept of a “burden rate” and why it is important. This term may have differing names by industry or have ...

Bookkeeping

Project Accounting Software Considerations

We’ve spent time discussing the structure of bookkeeping and the necessary tools to get a complete and accurate product. In this section, we’re ...

Bookkeeping

Purchase Order Systems

Most businesses have a disjointed process for submitting, reviewing, and approving purchase requests. Many don’t have a process at all. If you’ve ...

Bookkeeping

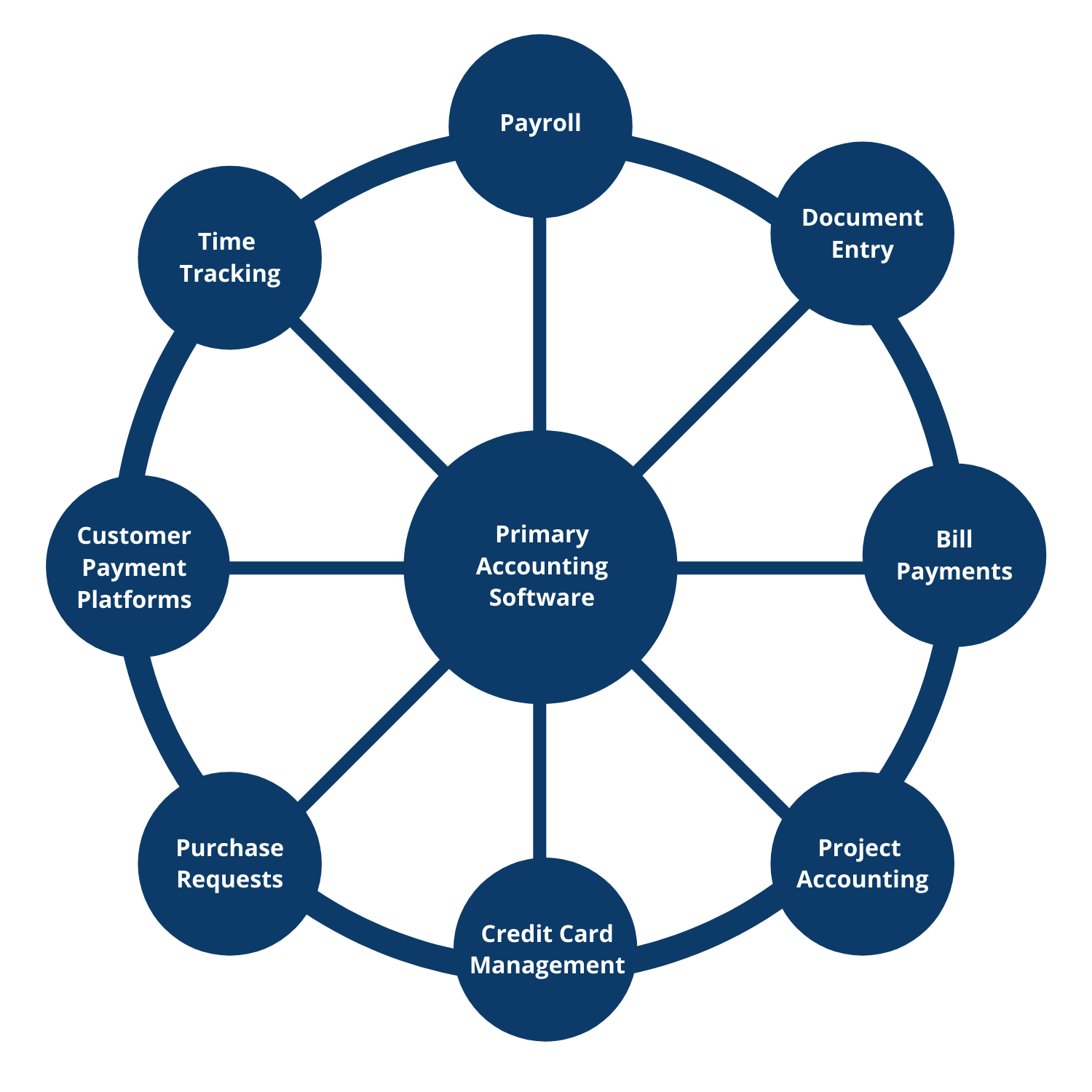

The Wagon Wheel

The wagon wheel concept is a visual representation of how multiple accounting applications come together to form a unified, customized system. It ...

Bookkeeping

Document Hub & Bill Entry

A core bookkeeping automation tool is a document collection / bill entry software. This type of software is incredibly helpful and serves several ...

Bookkeeping

Payroll Tools

Like time tracking, payroll processing is often a tedious and disliked process. It’s an important part of any business though and there are ways to ...

Bookkeeping

Centralize Oversight, Decentralize Data Entry

Bookkeeping automation facilitates a structure in which financial management, controls, and oversight are centralized, but the data entry is ...

Bookkeeping

Bill Payment Platforms

Most people are familiar with the online bill pay feature included with their bank, but did you know there are bill payment platforms specially ...

Bookkeeping

Bookkeeping Warning Signs & When To Outsource

When should you consider outsourcing your bookkeeping? What are the benefits of outsourcing? In today’s post, we’re going to share some bookkeeping ...

CFO

Credit Card Best Practices

Most businesses rely on credit cards to make daily purchases in their company. From inventory to supplies, materials and advertising, almost every ...

Bookkeeping

The Importance of Time Tracking

Time tracking is an integral part of many businesses but it’s often a tedious and disliked part. Despite this, time tracking is highly important on ...

CFO

Budget Best Practices

In its simplest terms, a budget is a realistic estimate of future revenues and expenses. This is an important exercise for a business to do at least ...

Bookkeeping

Credit Card Management Systems

Now that you have a company credit card, it’s time to implement a system to oversee it. The two big players in the industry are Abacus and Expensify, ...

Bookkeeping

Xero or Quickbooks?

So you’ve made the decision to move from a desktop accounting application to the cloud. The next question is, which vendor will you choose? There are ...

Bookkeeping

Why is Good Bookkeeping Essential for your Business?

Bookkeeping is the daily recording of financial transactions so you can tell how much income your business made, how much you spent, and how much was ...

CFO

Modern Envelope System

Before technology and credit cards ruled our lives, cash was king. It was simple to not spend more than you had because if it wasn't in your wallet, ...

Bookkeeping

Why Cloud Accounting

The future of accounting is in the cloud and the future is here. Before we dive into this topic, you must understand that your approach to accounting ...

Ready to Experience Financial Clarity?

Let our team of experts help you navigate the financial frontier. With a personal touch and a commitment to your growth, we’re here to guide you every step of the way. Reach out today to see how we can help you move forward.